capital gains tax changes canada

This strategy largely involves hitting them with a 75 percent capital gains rate. When the tax was first introduced to Canada the inclusion rate was 50.

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Owners feel this will unfairly target them.

. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. This increased to 75 in 1990 and was then reduced back to 50 in 2000 where it has remained for the last 20 years. Gains inclusion rate may occur in the upcoming federal budget.

The below outlines the current tax treatment of capital gains in Canada and the US the appetite for change in each country and a few questions to ask your financial planner about realizing capital gains before December 31 2020. Candidates and their political parties are proposing several changes to the current tax schemes. A buck is a buck the Commission famously argued.

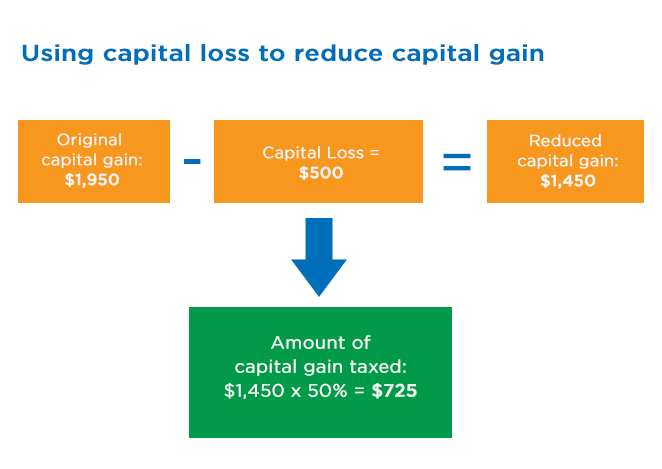

The capital gains tax in Canada was implemented in 1972. On a capital gain of 50000 for instance only half of that amount 25000 is taxable. The federal budget date has.

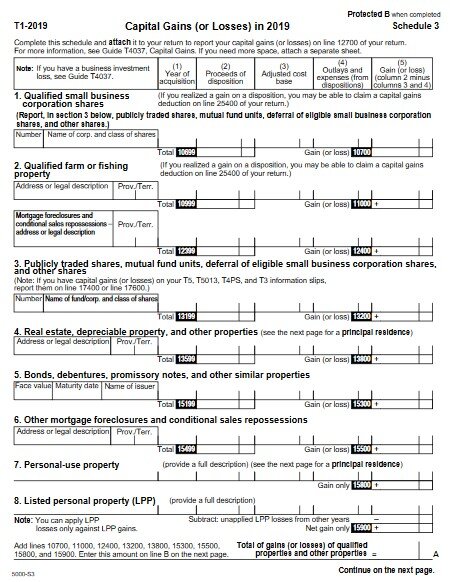

For tax purposes the gain would only be half of 35. The taxes in Canada are calculated based on two critical variables. For more information see What is the capital gains deduction limit.

Once you have realized your capital gains off of an investment asset you need to pay taxes on them as well. How Much Capital Gains Is Tax Free In Canada. One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an equivalent fair market.

This has Canada speculating again if a hike to the capital. If a change to the capital gain inclusion rate is announced. For individuals in Ontario the highest marginal rate applied to capital gains is 2676 while the highest marginal rate applied to dividends is 4774 technically it should be noted that capital gains are subject to the same top marginal rate of 5353 as income but given that only 50 of a capital gain is taxable it is common shorthand to refer to capital gains as.

For now the inclusion rate is 50. This week the NDPs Jagmeet Singh promised to crack down on big money house flippers. The inclusion rate refers to how much of your capital gains will be taxed by the CRA.

A complex and imperfect capital gains refund mechanism is intended to prevent such double taxation but in practice often provides only partial relief. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. The capital gains tax rate in Ontario for the highest income bracket is 2676.

Capital gains tax changes 2021 canada. NDPs proto-platform calls for levying. This is the income inclusion rate that generally applies to non-registered investments cottages rental.

Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972. In Canada 50 of the value of any capital gains are taxable. Current Treatment Canada In Canada the current capital gains inclusion rate is 50.

The imperfect nature of the capital gains refund mechanism has led to the practice in the mutual fund industry of allocating capital gains to investors who redeem their units the ATR methodology. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an estimated 190 billion annually or 57 per cent of all federal and provincial income tax revenues.

The Canada Revenue Agency CRA imposes capital gains tax on investment gains realized through the sale of certain assets. The federal income tax brackets. And the tax rate depends on your income.

A capital gains deduction of 431692 two-thirds of a LCGE of 883384 applies to QSBCS gains in 2020In 2019 QSBCS can award an interest deduction of 433456 12 of a LCGE of 866912. A capital gains tax increase would be a form of annual wealth tax that would be. For the past 20 years capital gains in Canada have been 50 taxable.

Taxes on Capital Gains. Guidance on affidavits and valuations Bill C-208 As of June 2021 changes to the Income Tax Act have altered the tax treatment of family transfers of shares in a qualified small business corporation and shares of the capital stock of a family farm or fishing corporation. For the 2021 tax year and tax season the deadline to file tax returns for most filers is May 2 2022.

This week the ndps jagmeet singh promised to crack down on big money house flippers. Increasing the capital gain inclusion rate may be one tax change the Canadian government could consider in order to boost tax revenues. Generally capital gains are taxed on half of the gain.

Election platform the NDP proposed to increase the capital gains inclusion rate. Canadian real estate and capital gains taxes are once again in the spotlight. Capital gains tax.

Tax Changes in 2022. For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would have a capital gain of 35. September 1 2021.

While we cant say for sure whether capital gains will be restricted or the GST will increase below we have covered the tax rate changes in Canada we know about so far for 2022. Capital Gains Tax Rate. This has Canada speculating again if a hike to the capital gains inclusion rate may occur in the next federal budget.

Federal Tax Rate Brackets in 2022. The Royal Commission on Taxation led by Kenneth Carter had earlier recommended that since capital gains gifts and bequests improved the welfare of the fortunate recipients such gains must be taxed like income and wages. The rate of capital gains in tax in Canada has changed several times since it was introduced in 1972.

At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province. The cra has increased indexation rates to 24 for the next year up from 1 in 2021. The tax base includes profits or losses made by selling investments such as stocks bonds mutual funds and listed securities.

This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax. To 75 from 50.

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Understanding Taxes And Your Investments

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Pay Less Tax On Your Capital Gains The Independent Dollar

Capital Gains Tax In Canada Explained Youtube

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Tax In Canada Explained

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax Calculator For Relative Value Investing

Hiking Capital Gains Taxes Bad For The Economy And Canada S Middle Class Fraser Institute

The Taxation Of Capital Income In Canada Part I Taxes On Dividends And Capital Gains Finances Of The Nation

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy